Payment Outlook: 60% of MA Plans Cover Telehealth, 95% of Post-Acute Providers Subject to Alternate Models

By Alex Spanko | January 26, 2020

The new fee-for-service Medicare model absorbed much of the oxygen around nursing home payment reform in 2019, but 2020 — as well as the years beyond — will bring a slew of alternate payment pressure to the post-acute sector.

Over the next two years alone, 95% of post-acute operators will find themselves in new payment models, according to a January report on 2020 health care trends from consulting firm Avalere Health — while Medicare Advantage will continue to expand its footprint into an array of new covered services.

“Medicare is reorienting payment around patient needs rather than resource utilization, while MA plans and accountable care organizations are encouraging patient care in the lowest-cost, clinically appropriate care settings,” the Washington, D.C.-based Avalere noted.

The Patient-Driven Payment Model (PDPM), which became the standard fee-for-service reimbursement system for nursing homes last October 1, represented a step in that direction, shifting incentives away from therapy volume and toward resident need. Though the early returns have been positive — with multiple sources reporting widespread payment boosts in PDPM’s first months — experts have warned that downward adjustments could be coming if the federal government determines that the model strays too far from its revenue-neutral goal.

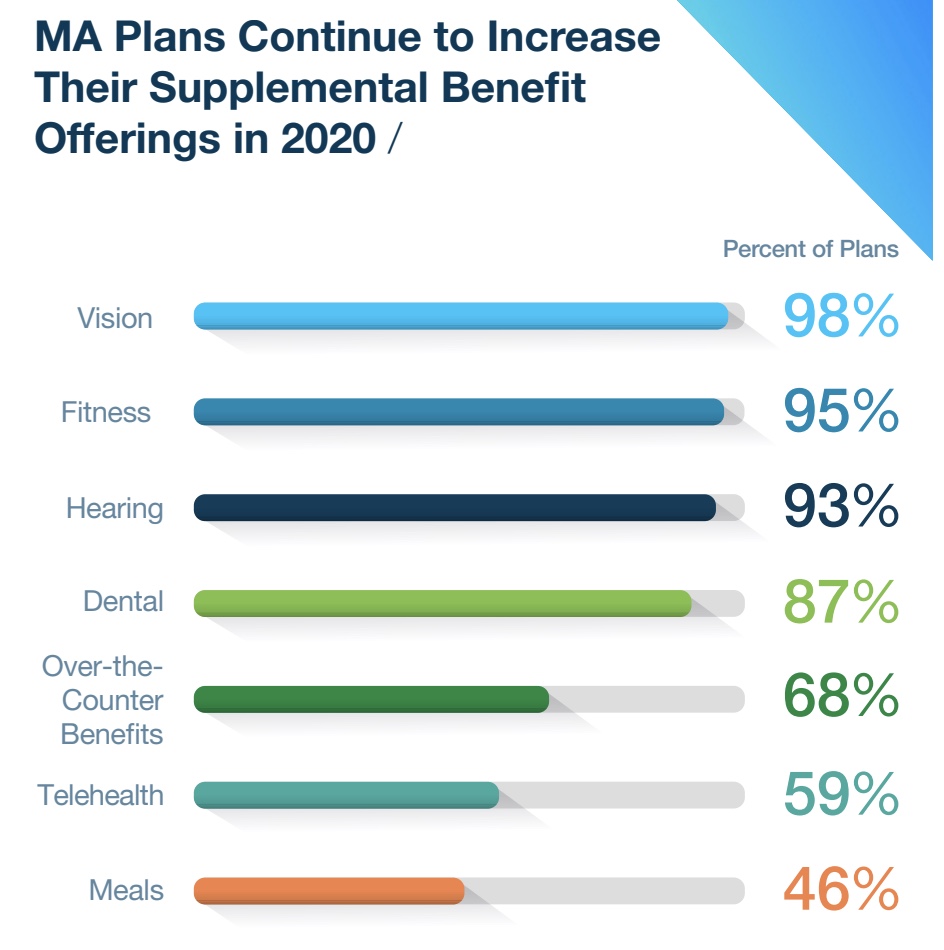

But PDPM only represents one front in the changing payment landscape. Medicare Advantage plans have rapidly expanded their offerings for the 2020 plan year, with more than 59% covering telehealth services — a move that some operators in the space have eyed as a key opportunity, particularly in the wake of a 2019 federal rule making it easier for MA plans to pay for telehealth interventions.

“The breadth of MA benefits continues to expand and evolve to meet patient needs,” Avalere managing director Fred Bentley said in the report. “Plans have more flexibility to offer benefits targeting specific populations, creating opportunities for new partnerships.”

On top of Medicare Advantage, Avalere estimated that 95% of all post-acute providers will find themselves in some kind of alternative payment model in 2020 and 2021, prompting the consulting firm to advise operators to consider diversification to weather the changes — while also exploring the increasingly popular Institutional Special Needs Plans (I-SNPs), special Medicare Advantage plans for long-term care residents.

“Post-acute care providers will increasingly need to demonstrate their unique value relative to other care settings and evaluate opportunities to diversify into home health,” Avalere observed. “Some providers may choose to become payers themselves, launching Special Needs Plans to secure their foothold in the changing market.”