Why 2020 Will Launch the Medicare Advantage Boom in Home Care

By Jack Silverstein | July 23, 2019

The Medicare Advantage revolution continues to grow — and starting in 2020, home care providers will reap the rewards.

Through a series of law changes over the past decade, including the Patient Protection and Affordable Care Act of 2010 and the Bipartisan Budget Act of 2018, Medicare’s move away from fee-for-service models and toward value-based care is sweeping the nation.

The Centers for Medicare & Medicaid Services (CMS) calls this national shift a “part of our larger quality strategy to reform how health care is delivered and paid for,” focusing on improving care for individuals, improving health for populations and lowering total costs.

And this is where home care comes in.

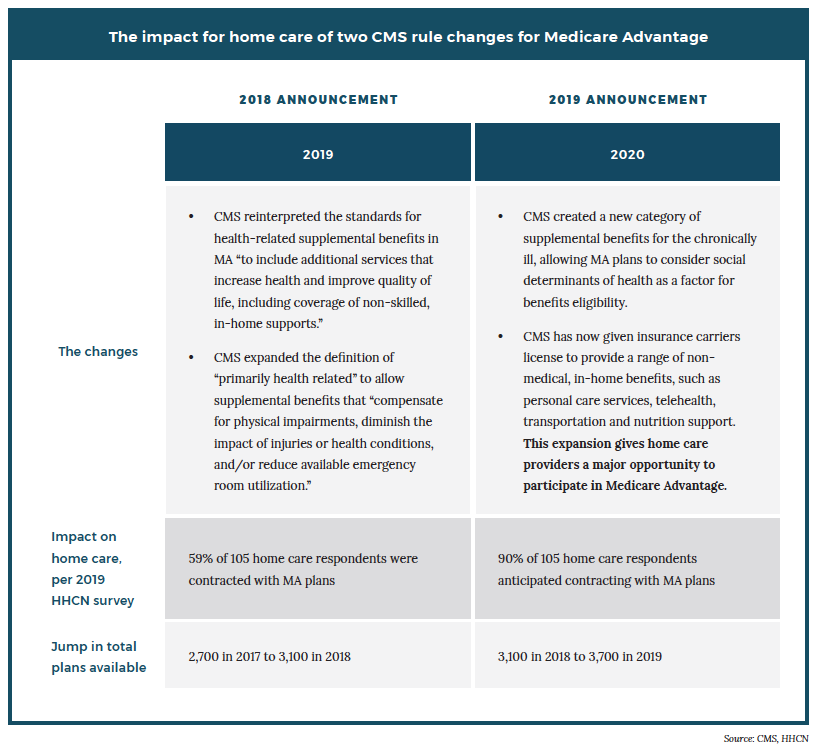

In each of the past two years, CMS has made rule changes aimed at bringing home care into the Medicare Advantage (MA) fold. The first rule, announced in 2018 for 2019, reinterpreted the standards for health-related supplemental benefits to include additional services “that increase health and improve quality of life, including coverage of non-skilled, in-home supports.”

The second, announced this year for 2020, expanded the definition of supplemental benefits to include any services that “address social determinants of health for people with chronic disease.”

The second rule is monumental. Yet debate remains as to when the MA opportunity for home care will reach its most fertile point.

It could be 2020, the year in which MA plans can be as creative as they want in offering benefit packages with non-medical, in-home services. It could be 2021, the first year in which data showing outcomes and impact of home care is available, as well as a full year for plans to adjust their reimbursements to the liking of home care providers.

It could be 2022 or beyond, assuming that just one year is not enough to get everyone — providers and payers — into the pool.

Our new report, “The New Medicare Advantage Opportunity in Home Care,” shows the changes coming in the next few years, and reveals the key reasons why home care providers who want to jump into MA have wisely already done so for 2020.

“2019 is a very skinny, little, experimental year that is just reflective of some regulatory changes CMS made,” Medicare Advantage expert Anne Tumlinson, founder of Washington, D.C.-based research and advisory services firm Anne Tumlinson Innovations, told HHCN. “2020 is really year 1 — the year where CMS is now implementing a new law (…) .”

Value-based care, home care and MA

The national shift in health care from fee-for-service to value-based care has been nearly as comprehensive as it has been fast.

A recent Change Healthcare study concluded that over a five-year period, the number of states and territories implementing value-based reimbursement (VBR) programs increased seven-fold. The study shows that value-based reimbursement models now exist in 46 states plus the District of Columbia and Puerto Rico.

To put it simply, the U.S. health care system is moving away from treating people only when they’re sick, instead focusing on proactively keeping them well. While insurers want to keep costs down in either fee-for-service or value-based care, namely by limiting the time members spend in high-cost, acute settings, a value-based model intensifies that focus. Payments are predicated on cost and outcomes, not just services delivered.

Increasingly, insurers are realizing the role social determinants of health (SDoH) play in driving those outcomes. SDoH refers to the impact that an environment has on a person’s health, such as where they work, how they commute or, crucially with seniors, where they live. A senior with a disability or chronic health condition, whose mobility is limited, spends a lot of time in these settings.

And while different sources offer different estimates of the savings of home care vs. other settings, all agree that the longer a person stays in their home, the more money is saved, whether to the senior or the payer.

The money is big.

A May 2019 study from the Johns Hopkins Bloomberg School of Public Health estimated a hypothetical incremental cost savings of $4 billion in Medicare spending if community-living adults 65 or older with disabilities received non-medical care, specifically around household activities, mobility and self-care.

Those three areas reside at the heart of home care’s value. That’s what makes the CMS expansion so significant for home care providers: It lets them receive Medicare reimbursement by tapping into MA, which now serves 34% of all Medicare beneficiaries, with 22 million total enrollees.

Efforts to keep seniors in their homes typically take three forms:

- Proactive non-medical care that reduces preventable health failures by targeting the root causes of common medical conditions

- Health care services in the home rather than in a hospital, ensuring a person’s isolation from other sick people when they themselves are most vulnerable

- Reducing readmissions once a person returns home from the hospital

With its supplemental benefits not offered by Medicare and its built-in cost controls, Medicare Advantage is a natural fit with the value-based movement. And over the past 15 years, MA’s popularity has soared, likely for those reasons. Indeed, of the 541 MA contracts in June of 2019, only five remained in a fee-for-service plan type.

Ideally, MA would be a crucial component to keeping people out of the hospital and keeping them healthy. Indeed, a 2017 study sponsored by CMS found that MA beneficiaries in California, Florida and New York outperformed fee-for-service Medicare beneficiaries in 16 clinical quality measures, including preventative care, chronic condition management and -— the big one — hospital readmissions.

Yet other studies have not been as kind to MA.

A recent review by Kaiser Family Foundation (KFF), for example, showed that people who switched from Medicare to MA in 2016 spent about $1,200 less a year on health care than ones who stayed on Medicare, suggesting that MA’s impact on the country’s most at-risk seniors is moderate. This is significant because 90% of the $3.3 trillion spent annually on health care in the U.S. is for people with chronic physical or mental health conditions.

Additionally, a study from Brown University in June 2019 found that MA patients had slightly higher hospital readmission rates (17.2%) than their peers in traditional Medicare (16.9%).

In response to the same trends driving those studies, CMS made its rule changes, taking a renewed and deeper focus on improving seniors’ SDoH as a means of keeping them out of the hospital.

An emphasis on SDoH is an emphasis on home care, addressing a senior’s health through home care services such as personal care, transportation, socialization, nutrition support and home modifications.

The Johns Hopkins study estimating the $4 billion savings did not include MA enrollees. But the results put a dollar figure on the impact home care can have for Medicare beneficiaries.

2020 vs. 2021 vs. 2022 and beyond

Because MA is heading steadily toward becoming the predominant offering within Medicare, the opportunity for home care providers to benefit from these MA expansions should only continue to grow over the next few years. Just when that opportunity will boom is still a matter of debate.

“We do not believe [MA and home care] is a 2020 event,” Addus CEO Dirk Allison said at a conference last month. “We believe it’s more of a 2021 event, largely because I think that the plans have to file this month for their 2020 plans, and [CMS] clarified the rule about six weeks ago. I don’t think that MA plans have the time to really put the thought in for 2020.”

That is a view held by many providers and payers alike. Yet an HHCN survey in May of 2019 showed that home care providers are already jumping into MA. Of 105 home care provider respondents, 59% said that they were already contracted with an MA plan in the plan year of 2019. That figure jumps to 90% for 2020.

“We want to be engaged with the MA plans early in order to help inform the expectations of a home care partner to be able to demonstrate value to the plan and their enrollees, and in return for home care providers to be able to expect fair requirements and reimbursements from the plans,” Jennifer Ramona, vice president of strategy and health care innovation at the Denver-based franchisor Homewatch CareGivers, told HHCN in April. “We are not waiting for 2021.”

Whether a provider follows Homewatch CareGivers’ lead or Addus’s, the bottom line is this: The change is here and will continue to grow.

“I think there is going to be a really steep and fast learning curve for the Medicare Advantage plans themselves between now and 2022,” Tumlinson said. “They’re trying to understand a variety of different things around not just home care benefits but all of the things they can offer under the supplemental benefit flexibility.”

But with MA enrollment increasing and CMS seemingly going all-in on its emphasis on SDoH and the value of home care within MA, the opportunities for home care providers should only increase. And this is all without considering the possibility of yet another expansion from CMS some point down the road.

“You have to play,” Ramona recently told HHCN, “or you’re going to lose clients.”

Both Ramona and Gavin Ward, regional director of strategy and partnership at 24 Hour Home Care, view the MA opportunity of 2020 as a greater chance to “make history” than to make money. The degree to which the profits will roll in, as well as the timeline for any great payday, remains uncertain.

No matter the timeline, though, the clock is ticking.

“From a growth and attracting new members standpoint, having something like this that is unique and better than what our competitors offer certainly is helpful,” Chris Boles, regional vice president of Medicare at Anthem, told HHCN in October 2018. “But it goes beyond that and gets into our commitment to developing products that really do help address the health and wellness of our members.

“If we don’t do that, there’s no reason for members to sign up with us and no reason for them to stay.”